Tax season is the most crucial time for businesses, regardless of size. You can experience stress during tax season due to submitting many tax returns. Filling your taxes, whether as an individual or a company owner, can be a tedious process.

Your tax filing experience can be a pain if you must handle a lot of paperwork. But, if there was a method to streamline your tax filing- The tax preparation outsourcing!

Saving time and money while increasing accuracy is a breeze with tax outsourcing! Let’s walk through the tax preparation outsourcing for a better understanding!

Table of Contents

ToggleWhat is Tax Preparation Outsourcing?

Small businesses can contract with third parties to prepare their tax returns via outsourcing services. This can help companies save time during tax season by reducing workloads. These services have skilled tax experts working with the business’s in-house team, adhering to the same processes.

Why Tax Preparation Outsourcing?

Time-Saving Tax Outsourcing- Save significant time to focus on core business activities.

Outsourcing tax preparation can save you time by avoiding handling tax processes in-house. Your time might be better spent on other essential tasks for your company. If you outsource your tax preparation, you can reduce the time you spend filing by as much as 40%.

Cost-Effective Tax Preparation- Save money in the long run.

Tax preparation outsourcing can reduce overhead expenses by eliminating recruiting an in-house team. It can help you save money by reducing the likelihood of fines caused by inaccurate tax returns. Compared to the price of doing it yourself, outsourcing tax preparation might save you as much as 60%.

Increased Accuracy in Tax Filing- Get precise tax filing by minimising fines.

You can save stress by outsourcing tax preparation, which can streamline your tax filing. You do not need to stress about keeping up with ever-evolving tax rules. Aside from that, you won’t have to worry about the hassle of submitting your taxes.

Access to the Latest Tax Software- Advanced technologies are at your fingertips for more efficiency.

Tax preparation outsourcing can enhance accuracy using cutting-edge tools. Access to advanced tools is essential to reduce errors by staying in line with all tax laws in Ireland.

Comply with all the latest Irish tax laws to gain a competitive edge- Boosting compliance.

Tax preparation outsourcing services can boost compliance by handling all your tax needs and giving you paperwork to back up your tax returns. Staying compliant with Irish tax laws is difficult, but outsourcing partners play a crucial role in achieving this.

Getting Expert Guidance from Professionals- Continuous support for accurate tax filing.

Expert advice on various tax issues with tax preparation outsourcing, including deductions. Additionally, it can provide professional guidance for disagreements with the tax authorities. If you run into complications while submitting your taxes, they can help you fix them. Outsourcing partners stand by your side through all parts of your journey.

What to Look for in Reliable Tax Preparation Outsourcing Services?

Outsourced tax preparation services are plentiful, but not all are reliable. Depending on your needs, some can provide superior value. So, choose the right tax preparation outsourcing service provider with attention to detail.

When looking for a tax preparation firm in Ireland to outsource, consider:

Choosing a Reputable Tax Outsourcing Provider- Be Sure to Do Your Homework

Examine the service provider to learn more about their expertise. Check various tax preparation outsourcing services to identify the best fit.

Data Security During Tax Outsourcing- Weigh Your Alternatives

Consider the services of each choice before making a final decision. Get estimates from different service providers to choose an effective partner. Finding a service provider that meets all your needs is essential.

Quality Control in Outsourced Tax Preparation- Make Your Requirements Clear

Ensure you tell the service provider exactly what you need. Also, provide them with all the paperwork to complete your tax returns. You should also let them know if you have any special requests about your tax returns.

Compliance with Tax Regulations- Check Their Progress

Before giving your approval, ensure you have reviewed their work. If you notice any mistakes, you need to request corrections.

Collaboration with the Outsourcing Team- Assess Their Performance

A few criteria should be considered when you assess the tax consultants’ performance. Giving them constructive criticism on how to improve is a good idea. You should keep an eye on their progress to make sure they are in line with your standards.

Looking Ahead at Tax Preparation Outsourcing

If you have any concerns about your taxes, the service provider is a good resource for expert support. But where do tax outsourcing services go from here?

Enhanced Efficiency with Advanced Technologies: Using cutting-edge solutions to manage recent tax regulations can lead to increased automation. These resources can help you prepare your taxes using several advanced technologies.

Enhancements to Customisation with Insights: Using data that can comprehend your needs might lead to a tailored approach. To provide personalised tax preparation services, this data could be used for predictive analysis. They could also offer a broader range of alternatives.

Improved Safety Over Financial Information: Using authentication, outsourced tax preparation services can keep your information safe. They use several authentication methods to provide more openness.

Enhanced Availability for Continuous Support: Remote tax accounting can simplify tax preparation outsourcing. To make tax preparation quick, these online platforms can use various tools. They could also provide more options, such as round-the-clock support.

Tax Preparation Outsourcing with Outbooks

Outsourcing tax preparation can provide businesses in Ireland with a significant competitive edge. No matter what obstacles you face, such as a shortage of personnel, inexperience, or overwhelming demand during tax season, tax preparation outsourcing can improve your service offerings.

Outsourcing tax preparation has several benefits, including meeting client needs and increasing customer loyalty. You can gain a competitive advantage by devoting more time to expansion, innovation, and exploring new specialised service offerings when you outsource your firm’s tax preparation.

Reputable outsourcing service providers set up the most advanced processes to ensure minimal friction. Outbooks will be the go-to tax preparation outsourcing partner in Ireland.

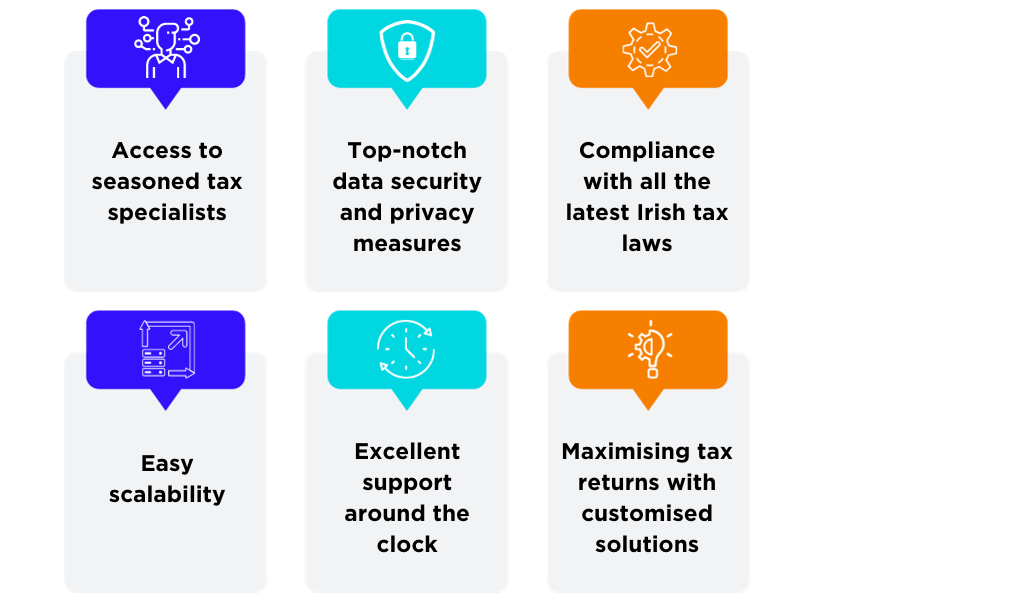

Choose Outbooks for:

- Access to seasoned tax specialists.

- Top-notch data security and privacy measures.

- Compliance with all the latest Irish tax laws.

- Easy scalability.

- Excellent support around the clock.

- Maximising tax returns with customised solutions.

Look no further than Outbooks in Ireland for tax preparation outsourcing!

Contact Outbooks at info@outbooks.com or +44 330 057 8597 to learn more about our reliable tax preparation solutions today!

Accurate Quotes at your fingertips with Outbooks Pricing Calculator.